March exports showed a whopping double digit growth of almost 60.50 percent clocking US$ 34.45 billion compared to March 2020. Reacting to March 2021 export figures, Sharad Kumar Saraf, President, FIEO, said that the monthly exports showed a whopping double digit growth of almost 60.50 percent clocking US$ 34.45 billion compared to March 2020, showing not only impressive signs of further revival for the sector but for the overall economy as well. This has been mainly on account of 28 out of 30 major product groups of exports showing either a very impressive high positive growth starting with triple digit and almost all ending with a very high double digit growth defying all the odds during these difficult times. FIEO President added that the exports of other cereals, oil meals, iron ore, jute mfg. including floor covering, carpet, electronic goods, gems and jewellery, engineering goods, cereal preparations and miscellaneous processed item, rice, spices, cotton yarn/fabrics/made-ups, handloom products etc., meat, dairy and poultry products, ceramic products and glassware, drugs and pharmaceuticals, organic and inorganic chemicals, plastic and linoleum, handicrafts excl. Hand-made carpet, Marine products, Man-made yarn/fabrics/made-ups etc., Mica, coal and other ores, minerals including process, Petroleum products, RMG of All Textiles, Coffee, Fruits and vegetables, Leather and leather manufactures, Tobacco, and Tea were the sectors, which contributed towards showing such a whopping performance by the exports sector during the month. Such a whopping growth in exports during the month also helped in taking the merchandise exports to over USD 290 billion for FY 2020-21 during such difficult and torrid times, which was well forecasted by FIEO said Saraf. FIEO Chief also reiterated that the support and help provided by the Government …

Read More »Centre to develop Bhavnagar as container manufacturing hub, expects Rs1000 crore investment from private players

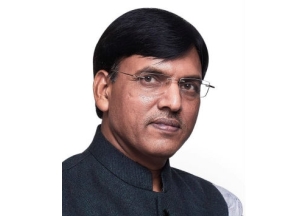

The Centre is looking to develop Bhavnagar in Gujarat as a container hub and has set up pilot projects for its manufacturing, informs Mansukh Mandaviya, Union Minister. The initiative aimed at attaining self-reliance in container production eyes Rs 1,000 crore investment from private players and looks to create one lakh jobs. The move assumes significance amid reports of global shortages of containers with Indian containerised trade taking a hit owing to the staggered supply and demand shocks across geographies as per logistic majors. “India requires about 3.5 lakh containers every year. There is no container production in India and we have to depend mainly on China which is a global producer. Now we want to develop Bhavnagar in Gujarat as a container hub and we have selected 10 places there for its production on a pilot basis,” Ports, Shipping and Waterways Minister Mansukh Mandaviya told PTI. The pilot project has been successful, he said. Mandaviya said the Ministry of shipping during the last six months has taken several initiatives to encourage container production at Bhavnagar with the help of re-rolling and furnace makers who are being encouraged to diversify in the space. We expect private players to invest about Rs 1,000 crore in this space. We also expect creation of one lakh local jobs. The intiative has been taken to realise the dream of Prime Minister Narendra Modi of ‘Aatmanirbhar Bharat’, he said. “We have formed a committee to look into the finer details like standardisation, certification etc. The committee comprises experts from Ministry of Shipping, IRS (Indian Register of Shipping), IITs etc,” Mandaviya said. Mandaviya said in days to come, India will start production which will be consumed by …

Read More »India’s Major Ports see 4.59% decline in cargo handling to 673 MT in FY’21: IPA

According to ports’ apex body IPA, “India’s 12 major ports has witnessed a 4.59 per cent fall in cargo handling to 672.60 million tonnes (MT) in the financial year 2021. These ports had handled 705 MT, 699 MT and 679 MT cargo in 2019-20, 2018-19 and 2017-18, respectively.” Recently, Mansukh Mandaviya, Minister of State for Ports, Shipping and Waterways, Government of India, said that the cargo traffic at 12 major ports declined considerably March onwards due to the adverse impact of the COVID-19 pandemic.”Percentage variation from previous year” in “traffic handled at major ports during April to March 2021 vis-a-vis April to March 2020” declined 4.59 per cent, the IPA said in its latest report. In the wake of the COVID-19 pandemic, sharp declines were witnessed in the handling of containers, coal and POL (petroleum, oil and lubricant), among other commodities. The percentage variation from the previous year was recorded at 4.59 per cent. All ports, barring Paradip and Mormugao (which recorded 1.65 per cent and 37.06 per cent increase in cargo handling to 114.54 MT and 21.95 MT, respectively), saw negative growth. Cargo handling at Kamrajar Port (Ennore) dipped 18.46 per cent during April-March 2021 to 25.88 MT, while ports like Mumbai and V. O. Chidambaranar saw their cargo volumes dropping by over 10 per cent during the said period. Cochin, New Mangalore and Chennai ports suffered a sharp decline of about 7 per cent. JNPT saw a decline of 5.32 per cent in cargo volumes, while Deendayal Port Trust and Kolkata ports logged an over 4 per cent drop in cargo volume. Cargo handling at Visakhapatnam slipped 3.96 per cent. India has 12 major ports under the control …

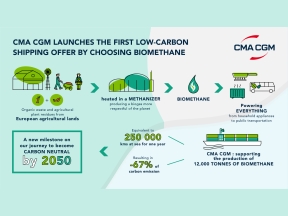

Read More »CMA CGM to offer carbon neutral shipping solutions, invests in biomethane production facility

Bringing the Group a step closer toward carbon neutrality, CMA CGM has launched the low-carbon shipping solution. Rodolphe Saadé, Chairman and CEO, CMA CGM Group has put forward solutions that are immediately available and that contribute to achieving the Group’s objective of being carbon-neutral by 2050. The CMA CGM Group has reached another milestone in its efforts to be carbon-neutral by 2050, by supporting the production of 12,000 tonnes of biomethane (equivalent to a year’s fuel consumption of two 1,400-TEU ships). Biomethane is a renewable green gas produced in part by the methanation of European-sourced organic and plant waste. This energy source represents a fine example of how the circular economy can work while benefitin g the agricultural sector. CMA CGM intends to push ahead with the development of this energy source by investing in biomethane production facilities and studying the viability of liquefaction processes so that biomethane can be rolled out as a shipping fuel. By supporting biomethane production, CMA CGM is accelerating its commitment to leading the energy transition in the shipping sector. The Group cut its overall CO2 emissions by four per cent in 2020, following a six per cent reduction in 2019. Since 2008, the Group has lowered its CO2 emissions per container-kilometer by 49 per cent. 12,000 tonnes of guarantee-of-origin (GO) biomethane is enough to fuel the equivalent of two 1,400-TEU LNG-powered ships operating on the Northern European Balt3 line between St Petersburg and Rotterdam for a whole year. Guarantee-of-Origin Biomethane, coupled with CMA CGM’s dual-fuel gas-power technology, can reduce well-to-wake (entire value chain) greenhouse gas emissions (including CO2) by at least 67 per cent. On a tank-to-wake basis (at ship level), the reduction in …

Read More »MMC partners with Ramco Systems to digitally transform five ports in Malaysia

MMC Corportation Berhad (MMC) has embarked on a major digital transformation of five ports, in partnership with global software solutions leader, Ramco System. The digital transformation will consolidate and standardise processes of MMC’s ports, which include Pelabuhan Tanjung Pelepas Sdn Bhd (PTP), Johor Port Berhad, Northport (Malaysia) Bhd, Penang Port Sdn Bhd and Tanjung Bruas Port Sdn Bhd. The group-wide transformation was awarded based on the successful implementation of Ramco integrated Enterprise Resource Planning (ERP) system at one of Malaysia’s most advanced container terminal – PTP. This technological transformation programme will propel Malaysia to the forefront of global best-in-class ports – which plays a crucial role in mitigating supply chain challenges, including recent disruptions due to COVID-19. Building on an earlier implementation by Ramco Systems of an ERP system for PTP where about 90 per cent of the system has achieved Go-Live in phases over the past 10 months, the enhanced rollout will digitalise processes, while providing real-time business information. MMC will also be able to consolidate various business support functions (namely Finance, Human Resource, Enterprise Asset Management, Supply Chain Management, and Logistics Management) across ports into a single integrated ERP system – all accessible on an integrated dashboard. Over 8,000 MMC employees across the ports will be plugged into the platform on their computers/mobile devices which now eliminates duplication errors and other bottlenecks, allowing efficient business processes and enhanced data visibility. The system will also include smart features such as Artificial Intelligence and Machine Learning (AI/ML), which will provide employees with greater insight as well as predictive alerts and chatbots which can reduce human error and save time. This will lay the foundation for MMC’s broader strategy to enhance …

Read More »DP World Mundra Terminal handles over 13 million TEUs & 10mn containers since 2003, sets record

DP World operated Mundra International Container Terminal (MICT) has set yet another record for being the first container terminal in Gujarat to successfully handle more than 13 million TEUs (twenty-foot equivalent units), and 10 mn Containers, since its inception. This milestone comes with the terminal achieving its all-time highest monthly throughput of 123,611 TEUs by handling 70 vessels in March 2021. MICT has registered a remarkable 60 per cent year-on-year growth on Origin Destination (OD) volumes over March 2020, surpassing overall India’s OD growth of 29.8 per cent for the same period. MICT is the first terminal at Mundra, the largest Port on western coast of India. From handling 20,000 TEUs in its first year of operations in 2003, the terminal has emerged as the gateway for the North and the North West regions of the country while pioneering the container revolution in the Kutch Region. MICT has achieved this breakthrough by handling more than 10,000 container vessels while serving international trade routes and contributing to the growth of India’s container trade and economic development. MICT continues to excel in areas of operations efficiency and deploying best-in-class infrastructure and technology, thereby, putting MICT in the top quartile of the best performing container terminals globally. The terminal’s proximity to North India market and excellent rail connectivity to the key ICDs and hinterland has made Mundra a strong first choice for Exporters and Importers. In the last quarter of 2020, MICT added two new mainline services to the Far East, providing direct and cost-effective connections. The terminal offers six mainline vessels and a vast network of feeder services which provide customers with faster and reliable connections to global markets. Capt. Sujeet Singh, …

Read More »CMA CGM Group & HPCSL launch first block train between Mundra and ICD Sanand, serving India’s hinterland

The CMA CGM Group and Hasti Petro Chemical & Shipping (HPCSL), known as The Thar Dry Port also, have jointly received their first ever Block Train from Mundra to the Thar Dry Port (ICD) at Sanand, Gujarat. This new service is the first block train by a shipping line between Mundra and ICD Sanand. The fully loaded 90-TEU train was flagged off from Mundra port on April 2nd and was received at ICD Sanand on April 3rd in the presence of representatives from The Thar Dry Port (A unit of Hasti Petro Chemical & Shipping) and CMA CGM India. The new weekly block train service is the first and only block train service by any shipping line, for Ahmedabad, Ex- Mundra. The train provides fixed window and dedicated service for customer import shipments ensuring a reliable departure schedule. The schedule departure of train from Mundra Port will be on every Saturday/Sunday. This new service from Mundra to Sanand offers customers effective cargo handling and provides priority loading for urgent import shipments with no additional cost. Another key feature of the service is to have no partial loading from Mundra, as all the containers will arrive together as per bill of lading (BL). Going forward, the CMA CGM Group is planning on streamlining the service even more to have a priority connection with the Group’s Indamex and EPIC services, two major services of CMA CGM India, calling the Gujarat region. The company is developing sustainable door-to-door solutions to allow its customers to significantly reduce the carbon footprint of their transported goods. Compared to cargo movement via truck, the block train option reduces CO2 emissions by up to 67%.

Read More »Adani Ports increases its stake in Krishnapatnam Port to 100%, invests Rs 2,800 crore

Adani Ports and Special Economic Zone (APSEZ) is announcing the acquisition of the residual 25 per cent stake in Adani Krishnapatnam Port (Krishnapatnam Port) for Rs 2,800 crore. This will result in APSEZ increasing its stake from 75 per cent to 100 per cent in Krishnapatnam Port. Together with the 75 per cent ownership acquired in October 2020, the acquisition implies an enterprise value of Rs 13,675 crore implying an EV/ FY21 EBITDA multiple of 10.3x. Krishnapatnam Port is located on the east coast of India in Nellore district of Andhra Pradesh (~180 km from Chennai Ports) close to the border between Andhra Pradesh and Tamil Nadu. Krishnapatnam Port is an all-weather, deep water port has multi-cargo facility with a current capacity of 64 MMTPA. With a waterfront of 20 km and 6,800 acres of land, Krishnapatnam Port has a master plan capacity of 300 MMTPA and a 50-year concession. The port is expected to have volumes of 38 MMT, revenues of Rs. 1,840 cr and EBITDA of Rs. 1,325 Cr in FY21. Since the acquisition, Krishnapatnam Port has focused on business process re-engineering which has resulted in EBITDA margins improving from 57% in FY20 to 72% in FY21. Karan Adani, Chief Executive Officer and Whole Time Director, APSEZ said, “The consolidation of our ownership in Krishnapatnam Port reinforces APSEZ’s stride towards 500 MMT by 2025 and achieving our broader strategy of cargo parity between west and east coasts of India. Krishnapatnam Port is on track to handle double the traffic by 2025 and will deliver high growth through a multi-product and cargo enhancement strategy while enhancing return on capital employed. We are confident that we will be able to …

Read More »JNPT handles highest container volume of 527,792 TEUs during March 2021

Jawaharlal Nehru Port Trust (JNPT) has registered a throughput of over 4.7 million twenty-foot equivalent units (TEUs) in container handling as against 5.03 million TEUs during FY 2020. The total traffic handled at JNPT during the Financial Year 2020-21 is 64.81 million tons as against 68.45 million tonnes in FY 2019-20. The total container traffic handled in March 2021 stood at 527,792 TEUs, which is the highest container volume handled in a month, since inception. The total traffic handled at JNPT during the month of March-2021 is 7.33 million tonnes as against 5.93 million tonnes in March 2020, which is 23.53 per cent higher than the total traffic over the same month of last year. Major improvement in average turnaround time of all vessels by 2.62 per cent i.e from 29.42 hrs to 28.64 hrs as well as for container vessels by 2.01 per cent i.e from 25.82 hrs to 25.30 hrs from Pilot Boarding to De-boarding in FY 2020-21 in comparison with FY 2019-20. JNPT has five container terminals, taking an overview of the numbers terminal wise, APM Terminals Mumbai (GTI) handled 1.66 million TEUs, DP World NSIGT with 0.78 million TEUs, DP World NSICT with 0.75 million TEUs and the Port owned JNPCT with 0.54 million TEUs. The Newly developed BMCT handled around 0.93 million TEUs during the FY 2021. NSICT and BMCTPL have recorded 41.33% and 15.36% growth in FY 2020-21 in comparison with FY 2019-20 respectively. JNPT BPCL Liquid Cargo Terminal handled highest LPG during FY 2020-21 of 1.04 million tonnes from 70 vessels which is 22.35% higher as compared previous highest of 0.85 million tonnes from 57 vessels in FY 2019-20. JNPT also handled 6,097 …

Read More »Chairman-Elect, FFFAI urges for smooth connectivity and logistics infrastructure to strengthen trade among BBIN

In view of tremendous potential of cross border trade between Bangladesh, Bhutan, India and Nepal (BBIN) Shankar Shinde, Chairman Elect, the Federation of Freight Forwarders Associations in India (FFFAI) has recommended for seamless multimodal connectivity and strong logistics infrastructure in each of the above countries. Speaking at a webinar on ‘UN TIR System and its benefits of expansion to Bangladesh and other BBIN countries’, which was organised by FICCI in association with IRU Geneva, ICC Bangladesh and FFFAI, Shinde observed that accession to TIR Carnet would be immensely beneficial for the hassle-free cross border trade in this region. It would be pertinent to mention that FFFAI is one of the associates of TIR Carnet and have been working with the Government of India for International North South Transport Corridor (INSTC) project, under TIR Carnet. He also emphasised on well-defined policies to be framed up by the respective governments and well-trained officers including Customs and allied agencies engaged at the border check posts. Based on the INSTC route experience, where FFFAI had launched a trial run of containers, Shinde stated that point to point vehicle movement would be the pragmatic solution instead of re-working of unloading and reloading transshipment, to save cost and reduce dwell time. Accordingly, accession to TIR would expedite the process in this regard. He, however, highlighted various other challenges as regard to cross border cargo transportation, as witnessed in INSTC route. Shinde further suggested that the governments will have to provide more impetus on private logistics companies, NVOCC or multimodal logistics operators’ participation in the BBIN project and also important would be to create a BBIN website portal with complete information for trade participation and addressing issues. …

Read More » Cargo Breaking News

Cargo Breaking News