MatchLog, a digital first container logistics optimisation platform, has raised USD 3 million in its pre-series A round through Blue Ashva Capital, a leading Singapore and India-based VC, Rainmatter Climate, and Capital-A, a Bangalore based early-stage investor. The capital raised will be deployed to develop the tech platform further for AI and machine learning based pairing of cargo across India, grow the multi-modal share in addition to road transport and expand its footprint to more ports in India and around the world. MatchLog is the first company in India that offers at scale the ability to turnaround a container from an import to export cycle, thereby eliminating unnecessary empty runs to and from the container yards. MatchLog’s work results in significant fuel savings and directly contribute to the decarbonisation goals of the shipping industry. In 2021 alone, MatchLog saved 1 m + kgs of carbon emission through its efforts. MatchLog has also been able to develop strategic inroads with leading custom house agents, freight forwarders and transporters that ensures higher adaptability and acceptance by the trade at large.

Read More »Singapore remains the world’s busiest transshipment port

The Port of Singapore remained the world’s busiest transshipment port in 2021, while it registered a record high in container traffic of 37.5 million TEU(Twenty-foot Equivalent Unit). It also remained the world’s leading bunkering power with bunker sales crossing 50 million tonnes for only the second time and it commenced regular ship-to-ship liquefied natural gas (LNG) bunkering operations from March 2021. This comprised 49.99 million tonnes in conventional bunkers sales and 0.05 million tonnes in liquefied natural gas (LNG) bunker sales, according to the Maritime and Port Authority of Singapore (MPA). Meanwhile, the Asian port handled 599 million tonnes of cargo in total during 2021, with vessel arrivals reaching 2.81 billion gross tonnages (GT). Singapore has also been ranked the top Leading Maritime City of the World for a fifth consecutive time in the international benchmarking study by the Norwegian classification society DNV and the Norwegian consultancy, Menon Economics.

Read More »Maersk plans to achieve net zero-emission by 2040

On the back of rising customer demand for green transportation and technical cap, the container shipping giant A.P Moller Maersk prepone decarbonization plans by a decade. The company now plans to achieve net zero-emission in its’ business by 2040. With the sea responsible for transporting about 90% of world commerce, global shipping accounts for 3% of the world’s CO2 emissions, and the sector is underneath rising scrutiny to become greener and cleaner. “When we set the target back in 2018, it was truly a moon-shot target, where truth be told we didn’t have a lot of very specific plans,” said Henriette Hallberg Thygesen, Chief Executive of Fleet and Strategic Brands, Maersk. But since then, several technological advances on the vessel aspect in tandem with growing demand for carbon-neutral supply chains from large corporates such as Amazon and IKEA have been observed. Maersk set a 2030 interim target for a 50% reduction in emissions per transported container, and a 70% cut in absolute emissions from fully controlled terminals.

Read More »Container prices rise steeply at major ports of India due to Omicron

The spread of new variant Omicron, has disrupted the global supply chains causing the container prices to spike by 10-15% in January at all major ports of India. As per shipping companies, the Chennai port in the first week of January witnessed a rise of $2,100 (Rs 1,55,316) for a 20-foot dry container from about $1,880 in December. The average price of a 20-ft dry container in Mundra climbed to $1,950 in the first week of January from $1,763 in December. While the Nhava Sheva in Navi Mumbai rose to $1,900 against $1,775 in December. As per market officials, the price of a 40-ft dry container at Chennai Mundra and Nhava Sheva rose to $5,100, $4,900, and $4,850, respectively, from $4,780, $4,650, and $4,600, respectively, in December. Several factors including the widespread restocking by retailers in China ahead of the Lunar New Year starting February 1 and the country’s rising Covid-19 cases have accounted for the rise of container rates. “Container turnaround times at major ports in China are once again on the rise due to bottlenecks ports are facing because of rising Covid cases and logistical bottlenecks,” an official from Container xChange said.

Read More »Cargo movement to commence from Varanasi & Haldia to Pandu port in Assam

The movement of heavy cargo ships from Varanasi and Haldia to Pandu port in Assam through riverways is expected to begin by mid-2022,said Union minister, Sarbananda Sonowal. “Dredging work at critical junctures in the Ganga and Brahmaputra rivers has already been initiated by his ministry to facilitate the movement of large cargo ships. By mid-2022, I am hopeful that cargo ships of 2,000 metric tonnes from Haldia and Varanasi will start sailing to Pandu. This is going to be a major boost to trade and industry of the North-eastern region,”, he said. Support from experts in Tezpur University, IIT Guwahati, and IIM Shillong will be sought to make the dredging work successful in the Brahmaputra, the minister said. Further he added that the PM has instructed concerned authorities to make arrangements to dredge a stretch of 2-2.5 metre in the two rivers so that cargo vessels, passenger ships, and seaplanes can utilize it. “The potential of the Brahmaputra as well as other rivers of Northeast is huge and people will get direct benefit from the development of river tourism, cargo transportation, and an alternative economic transportation system,” Sonowal said.

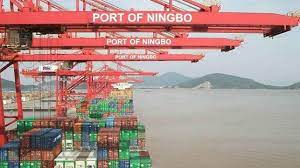

Read More »Ningbo Port halts operations amid covid-19 outbreak

The transportation of manufactured goods and commodities from the world’s most crucial port has slowed down dramatically after a suspension of trucking services in several parts of East China’s Zhejiang. There are strict controls on the movement of trucks carrying goods to or from the Beilun district in Ningbo after several Covid-19 cases were reported in the area, informed A.P. Moller-Maersk A/S. This COVID-induced suspension and restrictions on truckers in some areas in and around Zhejiang, has put a stop on operations at some of the yards and warehouses at Ningbo port. The curbs began last week after the Beilun district reported an outbreak of Covid-19 which led to the closure of colleges, warehouses, and firms close to the port.

Read More »MSC outranks Maersk as apex shipping line

According to a recent survey published by Alphaliner, Mediterranean Shipping Company (MSC) has outranked the Danish carrier A.P. Moller Maersk as the world’s largest container line, in terms of capacity. The shipping pioneer Maersk has been the loftiest since a few decades, however, Geneva-based MSC fleet can now carry 4,284,728 standard 20-foot containers, 1,888 more than Maersk. MSC has 645 ships with a combined capacity of 4,284,728 TEU, compared to Maersk with 738 ships with 4,282,840 TEU in capacity. “MSC’s path to the number-one spot in liner shipping has been one of organic growth, whereas Maersk owes its top ranking to the takeover of Sealand (in 1999), P&O Nedlloyd (2005) and Hamburg Süd (2017).” said Alphaliner MSC Chief Executive Officer Soren Toft said that they have been functioning towards growth and profitability, rather than being numero-uno. Maersk has often broken records by building the biggest ships and has recently invested in vessels that sail on carbon-neutral methanol. Lately, they have been focusing on growth in land-based logistics – eyeing higher profits – and have time and again mentioned that retaining the top spot isn’t important to the company. It still has the most capacity in terms of owned vessels: MSC has about 65% of its capacity from chartered ships whereas Maersk only has 42%.

Read More »Empty containers attract fine at Unites States’ Los Angeles Port

Starting the end of next month, empty containers stationed at the Los Angeles Port docks will attract a fee from the ocean carriers. The port of Los Angeles is United States’ largest port for container traffic and ocean carriers that fail to clear the empty containers off the port will have to bear a fine come 30th January. The port will charge USD 100 per day to the carriers for each empty container which has been stationed at the dock for more than 9 days. Each day the fine will increase by USD 100 until the container exits the dock. The fee, though, is subject to approval by the Los Angeles Harbour Commission’s board meeting scheduled for 13th January. A similar warning was issued on October 25th by the neighboring Long Beach Port too. “While we have seen significant success reducing import containers on our docks the past two months, too many empty containers are currently sitting on marine terminals. Just like the import dwell fee, the objective with this empty container program is not to collect fees but to free up valuable space on our docks, clearing the way for more ships and improving fluidity.” said Gene Seroka, Executive Director, Port of Los Angeles

Read More »Centre proposes incentives for Indian shipping lines

The Government of India explores a proposal to extend tax and other incentives to draw large players to set up shipping lines in India and provide aid to the exporters grappling with global container shortage and exorbitant freight costs. Likely to be announced in the upcoming Budget for 2022-23, subject to the finance ministry’s concurrence, the different initiatives are currently undergoing deliberation from ministries of commerce and shipping. It is learned that some officials are studying the attractive Ireland model of taxation for shipping firms. On finalization of a proposal, the ministries will seek the approval of the finance ministry. In the past year and a half, the Indian shipping industry in the wake of the pandemic has mirrored the global trend resulting in doubling the Shipping costs of Indian exporters to most destinations. The state-run Shipping Corporation of India (SCI) that caters for less than 5% of the roughly USD100-billion domestic market, has barely been able to keep the cost curve in orderly evolution. In light of this, the government has now put the SCI on the block for sale.

Read More »Continental Carriers transports break bulk cargo to Chittagong

Continental Carriers Pvt Ltd Chennai Ocean Team handled Break Bulk Project and shipped cargo of 195 Pkgs/366 Tons/908 CBM, Pol Chennai Pod Chittagong, on 25th December’ 2021. CCPL team obtained special permissions on X’mas holiday to complete the clearance activities. Continental Carriers (P) Limited is committed to finding innovative solutions and partnering with customer’s enabling them to find faster and better solutions to meet their requirements

Read More » Cargo Breaking News

Cargo Breaking News